Financing strategies, especially equipment leasing, are crucial for successful construction projects. Leasing offers flexibility and cost savings over purchasing heavy machinery, with maintenance and upgrade options. Effective lender evaluation and meticulous loan applications secure funding, while tax benefits like depreciation deductions make it an attractive option. By aligning financing with project goals, contractors optimize resources and maintain competitiveness in the industry through improved cash flow and access to cutting-edge technology.

In the fast-paced world of construction, efficient project management requires robust financing strategies. When it comes to securing equipment, choosing between purchasing and leasing offers unique advantages and considerations. This article explores essential financing strategies for construction projects, with a focus on evaluating lender options and the application process. We delve into the comprehensive benefits of equipment leasing, including its tax advantages, which can significantly impact project outcomes.

- Understanding Financing Strategies for Construction Projects

- Evaluating Lender Options and Application Process

- Advantages of Equipment Leasing: A Comprehensive Look

- Tax Benefits and Their Impact on Project Management

Understanding Financing Strategies for Construction Projects

Understanding Financing Strategies for Construction Projects

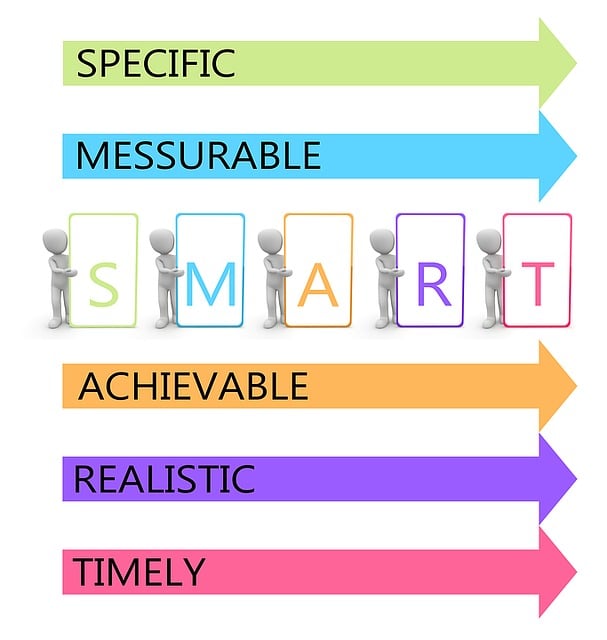

When it comes to construction projects, efficient project management heavily relies on securing adequate financing. One of the key decisions contractors and businesses face is choosing between purchasing or leasing heavy equipment. Equipment leasing offers a flexible financing strategy where companies can obtain machinery without the long-term commitment of ownership. This method often includes options for maintenance, repairs, and regular upgrades, streamlining project costs.

Effective lender evaluation and a well-prepared loan application are crucial steps in securing funding. For construction projects, exploring tax benefits tied to equipment leasing can also enhance financial outcomes. These advantages may include depreciation deductions and potential tax credits, making it a financially prudent choice for many businesses. By aligning financing strategies with project management goals, contractors can optimize their resources and stay competitive in the construction landscape.

Evaluating Lender Options and Application Process

When considering construction equipment leasing as a financing strategy, thorough lender evaluation and a meticulous loan application process are paramount to successful project management. Unlike purchasing, leasing allows companies to access cutting-edge machinery without the significant upfront costs, thereby improving cash flow and financial flexibility. However, not all leasing options are created equal; it’s crucial to explore various lenders and understand their terms and conditions. Look for providers that specialize in construction equipment financing, as they can offer tailored packages aligned with your project’s needs.

The application process involves submitting detailed information about the project, including its scope, timeline, and budget. This data helps lenders assess the risk associated with the lease and determine the most suitable terms. Additionally, exploring tax benefits associated with leasing can be a game-changer for construction businesses. Depending on local regulations, certain expenses related to equipment leasing may be tax-deductible, further enhancing the financial advantages of this strategy.

Advantages of Equipment Leasing: A Comprehensive Look

Construction equipment leasing offers a flexible and cost-effective financing strategy for businesses in the construction industry. Instead of purchasing heavy machinery outright, companies can lease equipment for a defined period, often with options to buy at the end. This approach provides several advantages, including significant savings on capital expenditure. Leasing allows contractors to access the latest technology without the burden of owning it, ensuring they have the right tools for each project. It also simplifies asset management since the lender handles maintenance and repairs, reducing operational costs and potential downtime.

One of the most appealing aspects of equipment leasing is the potential for tax benefits. Many countries offer incentives for businesses to lease rather than buy, allowing deductions for lease payments and interest on loans. This can result in substantial savings over time. Moreover, a lender evaluation and loan application process are often seamless, enabling quick access to funding for project management. Leasing also provides the freedom to upgrade or replace equipment as projects require, ensuring contractors stay competitive and efficient throughout their operations.

Tax Benefits and Their Impact on Project Management

Construction projects often require significant upfront investments in equipment, which can be a financial burden for businesses, especially smaller operations. This is where financing strategies like equipment leasing come into play. Unlike purchasing, leasing offers tax benefits that can have a substantial impact on project management. When a company leases construction equipment, the payments are typically structured as operating leases, meaning they often qualify for lower depreciation expenses compared to owning the assets outright. This can result in reduced taxable income, allowing businesses to free up cash flow and reinvest it into other critical areas of the project.

Furthermore, leasing provides flexibility in terms of loan applications and lender evaluations. Construction companies can tailor lease agreements to align with their project timelines, making it easier to manage cash flow throughout various stages of development. This accessibility to financing can streamline the overall project management process, ensuring that equipment acquisition doesn’t become a roadblock. By considering equipment leasing as a viable option, businesses can optimize their financial strategies and enhance their ability to handle complex construction projects efficiently.