Securing appropriate construction equipment financing is crucial for successful project execution. This involves understanding various financing strategies, including traditional bank loans and alternative methods like equipment leasing. Lender evaluation is a key step to secure competitive rates and terms, requiring an analysis of lenders' financial health, interest rate structures, and equipment leasing flexibility. By evaluating different financing options, providing detailed financial projections, and exploring tax benefits, builders can make informed decisions aligning with their budgets and long-term goals. Effective lender evaluation, combined with strategic loan applications and equipment leasing, enhances project management, improves cash flow, and enables efficient resource utilization on bustling construction sites.

“Unleashing Construction Dreams: Navigating Equipment Financing for Success

Embarking on new construction projects requires more than just a blueprint; it demands robust financial strategies. This article guides you through the intricate world of construction equipment financing, offering insights into essential components like understanding financing options, navigating lender evaluations, and mastering loan applications. Discover how equipment leasing can optimize cash flow while exploring the significant tax benefits that fuel project growth. Moreover, learn effective project management strategies fortified by financial backing.”

- Understanding Construction Equipment Financing Options

- The Role of Lender Evaluation in Securing Funding

- Navigating the Loan Application Process for Equipment

- Exploring Tax Benefits and Their Impact on Projects

- Effective Project Management Strategies with Financial Support

Understanding Construction Equipment Financing Options

Understanding Construction Equipment Financing Options

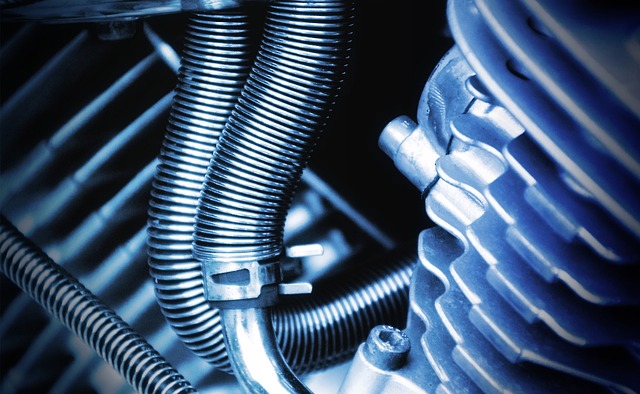

When embarking on new construction projects, securing adequate financing is a crucial step in project management. One of the key decisions builders and contractors face is choosing between various financing strategies for their equipment needs. Traditional loan applications involve approaching banks or financial institutions, presenting business plans, and demonstrating creditworthiness. However, with the rise of alternative financing methods, construction professionals now have more options to consider. Equipment leasing, for instance, offers flexibility by allowing businesses to rent equipment for a set period, providing tax benefits and potentially improving cash flow management.

Lender evaluation plays a significant role in this process. Builders should research lenders specializing in construction equipment financing to ensure competitive rates and terms. Understanding the different financing options—such as loans, leases, or even vendor financing from equipment manufacturers—enables informed decisions that align with project budgets and long-term financial goals. Effective project management often hinges on securing the right financing strategy, ensuring resources are available when needed most for construction sites bustling with activity.

The Role of Lender Evaluation in Securing Funding

When exploring construction equipment financing for new projects, lender evaluation plays a pivotal role in securing funding. Potential borrowers should carefully consider the financial health and reputation of lenders to ensure they offer competitive terms tailored to their project needs. A thorough assessment of the lender’s track record, interest rate structures, and flexibility in equipment leasing options is essential for successful project management. Lender evaluation also helps identify any hidden fees or restrictive clauses that could hinder cash flow.

During the loan application process, borrowers should leverage their understanding of financing strategies to highlight the benefits of tax advantages associated with certain funding methods. This proactive approach can lead to more favorable terms and a smoother transition into the construction phase. By aligning project goals with suitable financing strategies, businesses can streamline operations and maximize returns on investment.

Navigating the Loan Application Process for Equipment

Navigating the Loan Application Process for Construction Equipment can be a complex task, but it’s crucial for successful project financing. The first step involves evaluating various financing strategies, including traditional loans from banks, credit unions, or alternative lenders, as well as equipment leasing options. Each has its unique advantages and tax benefits, which should be carefully considered based on the project’s timeline and budget constraints.

During the lender evaluation phase, prospective borrowers must demonstrate robust project management capabilities to increase their chances of approval. This includes providing detailed financial projections, past performance records, and clear plans for equipment utilization and maintenance. A well-prepared loan application, complete with these elements, streamlines the process, ensuring a smoother path to securing the necessary construction equipment financing.

Exploring Tax Benefits and Their Impact on Projects

When considering construction equipment financing for new projects, understanding the tax benefits available can significantly impact your project’s financial health. Equipment leasing and specific financing strategies offer valuable tax advantages that can offset costs and enhance cash flow management. Lenders carefully evaluate loan applications based on these factors, making a thorough assessment of potential tax breaks crucial for successful project management.

Exploring tax benefits like depreciation deductions, deferred taxes, or special incentives for certain industries can make equipment leasing more attractive than traditional loans. These advantages not only reduce the immediate financial burden but also provide long-term savings. A well-planned financing strategy that incorporates tax considerations can free up funds, allowing contractors to focus on core project activities and stay competitive in the market.

Effective Project Management Strategies with Financial Support

Effective project management is crucial for any construction venture, and financial support can significantly enhance this process. One of the key strategies involves careful planning and a well-structured loan application. When seeking financing for equipment, whether through traditional bank loans or innovative leasing options, thorough preparation is essential. A comprehensive understanding of project timelines, budget constraints, and equipment needs will streamline the lending evaluation process, increasing the chances of securing favorable terms.

Equipment leasing can offer tax benefits and flexible payment structures, allowing businesses to manage cash flow more effectively. Project managers should explore various financing strategies and choose options that align with their operational goals. By strategically integrating financial support, construction projects can be seamlessly navigated, ensuring timely deliveries and optimal resource utilization.