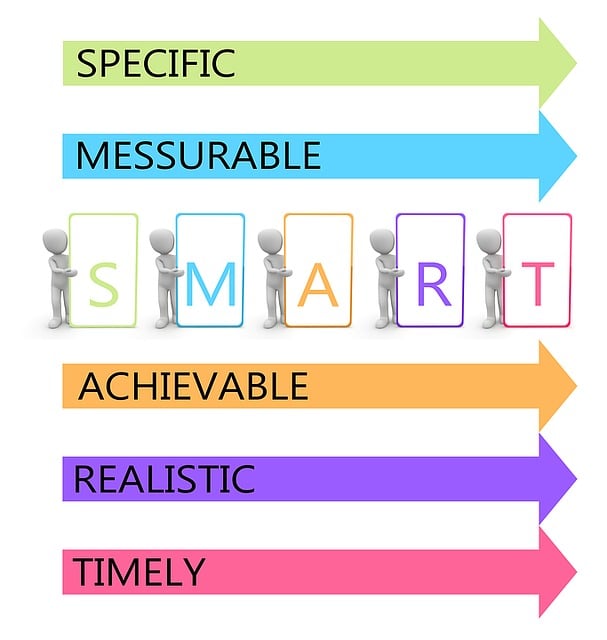

Small contractors aiming to expand their construction capabilities can utilize strategic financing strategies like equipment leasing and construction equipment loans. The process involves a thorough lender evaluation for the best terms, followed by submitting a detailed loan application. By comparing lenders based on expertise, understanding of project management, and responsive service, contractors ensure favorable agreements. Equipment leasing offers tax advantages and flexible conditions, enhancing financial stability and project execution. A meticulous approach to lender selection and well-prepared loan applications increase approval chances, providing access to essential equipment for successful project completion.

Small contractors often face challenges securing funding for their projects. Construction equipment loans offer a viable solution, providing essential capital for growth and expansion. This article explores the intricate world of construction equipment financing, focusing on strategies to navigate the loan process, evaluate lenders, and optimize tax advantages through equipment leasing. By understanding these key aspects, small contractors can streamline project management, secure funding, and thrive in their industry.

- Understanding Construction Equipment Loans for Small Contractors

- Financing Strategies: Exploring Loan Options and Requirements

- Lender Evaluation: Choosing the Right Financial Partner

- Maximizing Tax Benefits and Streamlining Project Management with Equipment Leasing

Understanding Construction Equipment Loans for Small Contractors

Construction equipment loans are a crucial financing strategy for small contractors looking to expand their fleet and take on bigger projects. These loans provide much-needed capital to acquire heavy machinery, such as excavators, backhoes, and cranes, which are essential tools for efficient project management. Understanding the process of securing these loans is key to navigating the financial landscape of construction.

When exploring financing options, small contractors should begin with a thorough lender evaluation. This involves researching banks, credit unions, and specialized lending institutions that cater to construction finance. Each lender may offer different terms, interest rates, and loan-to-value ratios, so comparing their proposals is essential. The loan application process typically requires detailed information about the contractor’s business, equipment specifications, and projected use, ensuring a clear understanding of how the funds will enhance project management capabilities and contribute to tax benefits.

Financing Strategies: Exploring Loan Options and Requirements

Small contractors often face a significant challenge when it comes to acquiring construction equipment—balancing the need for top-quality tools with limited financial resources. Exploring various financing strategies is crucial in navigating this hurdle. One popular option is securing construction equipment loans, which can provide much-needed capital for purchasing machinery and vehicles. Before applying, thorough lender evaluation is essential; different institutions have varying requirements, interest rates, and repayment terms. Understanding these factors helps contractors make informed decisions tailored to their project needs and financial capabilities.

A carefully planned loan application process involves demonstrating the project’s viability and one’s ability to manage finances effectively. Many lenders consider equipment leasing as an attractive alternative, offering tax benefits and flexible terms. Efficient project management, combined with a solid understanding of financing options, enables small contractors to secure the necessary resources without compromising long-term financial stability.

Lender Evaluation: Choosing the Right Financial Partner

When exploring construction equipment loans, small contractors should prioritize thorough lender evaluation to find the right financial partner. This process involves more than just comparing interest rates; it requires an in-depth look at the lender’s expertise in construction financing and their understanding of project management nuances. Reputable lenders who specialize in equipment leasing often offer tailored solutions that align with the unique challenges faced by small businesses, potentially including flexible repayment terms and built-in tax benefits.

A meticulous lender evaluation should also factor in the lender’s reputation for responsiveness and support throughout the loan application process and beyond. Contractors need financial partners they can rely on for expert guidance during project execution, ensuring smooth operations and successful completion. By selecting a lender with a proven track record in construction equipment financing, contractors can secure not just funding but also strategic partnerships that enhance their overall project management capabilities.

Maximizing Tax Benefits and Streamlining Project Management with Equipment Leasing

Maximizing Tax Benefits and Streamlining Project Management with Equipment Leasing is a smart strategy for small contractors looking to acquire construction equipment. Equipment leasing offers significant tax advantages by allowing businesses to depreciate the cost of assets over time, reducing overall tax liability. This method can also simplify financial management as lease payments are often structured to align with project timelines, making it easier to budget and forecast cash flow.

When considering financing strategies, small contractors should thoroughly evaluate different lenders and leasing options. A thoughtful lender evaluation process involves researching the reputation of potential lessors, understanding lease terms and conditions, and comparing interest rates and fees. By carefully reviewing these factors, contractors can secure favorable lease agreements that not only provide tax benefits but also support efficient project management. Submitting a well-prepared loan application with clear project scope and financial projections will enhance the chances of approval and access to much-needed equipment for timely project completion.