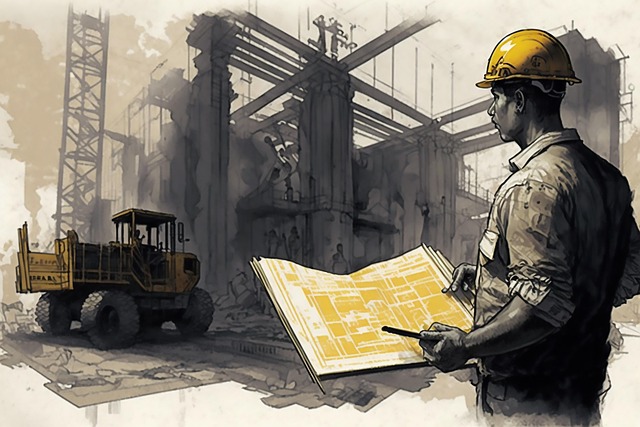

When seeking construction equipment loans, leveraging effective financing strategies like equipment leasing (offering tax benefits and flexibility) or exploring alternative lenders is key. A meticulous lender evaluation process based on interest rates, repayment terms, and customer reviews ensures the best fit. A robust loan application should include a detailed project management plan showcasing efficient equipment utilization to enhance creditworthiness. Careful decision-making between loans (long-term ownership & tax benefits) and leases (temporary access, simplified asset disposal) aligns with business goals and project management needs.

“Construction projects demand robust financial planning, especially when securing loans for heavy equipment. This comprehensive guide delves into the intricate world of construction equipment financing, offering a strategic roadmap for entrepreneurs and contractors. We explore various financing options, from traditional loans to innovative equipment leasing, highlighting their advantages and disadvantages.

The article navigates you through the process of evaluating lenders and applying for loans seamlessly, while also uncovering tax benefits and enhancing project management through equipment leasing. By understanding these strategies, you can make informed decisions, ensuring long-term financial stability and successful project outcomes.”

- Understanding Financing Strategies for Construction Equipment Loans

- – Exploring different financing options

- – Advantages and disadvantages of loans vs. leasing

Understanding Financing Strategies for Construction Equipment Loans

When considering construction equipment loans, understanding financing strategies is key to making informed decisions that align with your project’s needs and financial goals. The first step involves evaluating different lenders in the market to find one offering competitive terms and rates tailored for heavy machinery acquisitions. Lender evaluation should encompass factors such as interest rates, repayment periods, and any additional fees or charges.

A popular financing option is equipment leasing, which provides tax benefits by treating lease payments as business expenses. This can be particularly advantageous for businesses looking to manage cash flow effectively while keeping their balance sheets clear of long-term debt obligations. Additionally, a solid loan application should encompass a comprehensive project management plan that demonstrates the borrower’s ability to utilize and maintain the equipment efficiently, thereby enhancing their creditworthiness in the eyes of potential lenders.

– Exploring different financing options

When considering financial planning for construction equipment loans, exploring diverse financing options is a strategic move. Beyond traditional bank loans, options like equipment leasing and financing strategies from alternative lenders can offer tailored solutions for specific project needs. Careful lender evaluation based on factors like interest rates, repayment terms, and customer reviews can help ensure the best fit. Each financing method has unique advantages; for instance, equipment leasing may provide tax benefits while also allowing for easier asset replacement or upgrade.

A robust loan application process is integral to securing these options. Comprehensive documentation detailing project scope, timelines, and expected returns aids lenders in assessing risk. Effective project management that adheres to deadlines and budgets not only improves the chances of favorable loan terms but also demonstrates a borrower’s capability to handle financial obligations associated with such significant investments.

– Advantages and disadvantages of loans vs. leasing

When considering financing strategies for construction equipment, one of the key decisions is whether to opt for a loan or lease. Loans offer several advantages, including long-term ownership and potentially better tax benefits, especially if interest expenses are deductible. This can be advantageous for businesses looking to build equity and have more flexibility in managing their assets over time. Additionally, a loan application process allows owners to secure specific funding for equipment acquisition, enabling them to plan projects more effectively with precise financial resources.

On the other hand, equipment leasing presents unique benefits tailored to project management needs. Leasing provides access to modern machinery without the burden of long-term debt, making it ideal for temporary or fluctuating project demands. It also simplifies asset disposal as the lender handles ownership transitions. However, lease terms may not offer the same level of control over equipment use and maintenance as traditional loans. Careful lender evaluation is crucial when choosing between these financing strategies to ensure the selected option aligns with your business goals and project requirements.