Securing suitable construction equipment loans involves evaluating various financing strategies, with equipment leasing a popular choice offering flexibility and potential tax advantages. Businesses should thoroughly research lenders, comparing terms, rates, and reputations to mitigate costs. Submitting detailed loan applications highlighting equipment specifications, financial projections, and expected utilization improves chances of obtaining favorable conditions for successful project management. Understanding the pros and cons of traditional bank loans vs. leasing aids in selecting an optimal financing strategy aligned with project goals and business objectives.

In today’s competitive construction industry, securing optimal financing for heavy equipment is a critical component of successful project management. This article guides you through essential aspects of navigating construction equipment loans, focusing on practical financing strategies and leveraging resources effectively. From understanding various loan types and assessing lenders to mastering the application process and discovering tax benefits of equipment leasing, these insights equip project managers with tools to make informed decisions, ensuring smooth operations and financial efficiency.

- Financing Strategies for Construction Equipment Loans

- – Understanding the various financing options available

- – Advantages and disadvantages of different loan types

- Lender Evaluation and Selection

Financing Strategies for Construction Equipment Loans

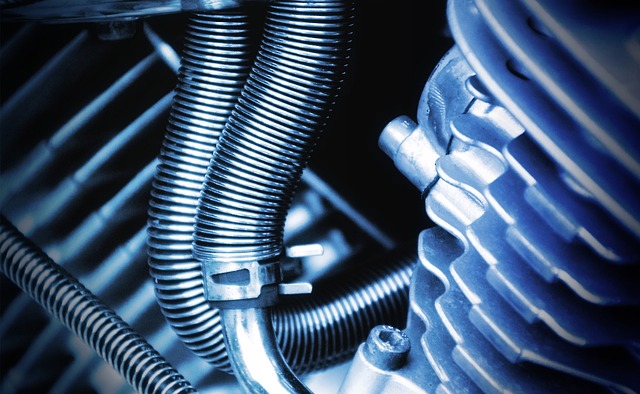

When it comes to securing funding for construction equipment loans, businesses have several financing strategies at their disposal. One popular option is equipment leasing, which allows companies to rent specific machinery or vehicles for a defined period, often with tax benefits. This approach can be particularly advantageous for project management as it provides flexibility and helps maintain cash flow by distributing costs over time.

Lender evaluation is another critical aspect of this process. Careful consideration should be given to the lender’s reputation, interest rate offerings, and terms. A solid understanding of these factors ensures that you find a suitable provider aligned with your project’s needs. Additionally, a comprehensive loan application, detailing equipment specifications, financial projections, and expected utilization, will enhance your chances of securing favorable conditions, ultimately contributing to successful project execution.

– Understanding the various financing options available

In the realm of construction, understanding the various financing options is a crucial step in effective project management. One popular strategy is equipment leasing, which allows businesses to borrow money from a lender to acquire necessary machinery and vehicles, with the option to return or purchase the equipment at the end of the lease term. This approach not only provides access to capital but also offers tax benefits as certain expenses related to leasing may be deductible. Additionally, comparing different lenders and their evaluation criteria is essential; factors such as interest rates, loan terms, and repayment conditions can significantly impact the overall cost of financing.

When considering a construction equipment loan, whether through traditional banking or alternative financing methods like leasing, careful evaluation of each option’s advantages and drawbacks is key. A thorough understanding of these strategies enables business owners to make informed decisions that align with their project goals. Each financing approach has its own set of requirements and implications for tax planning, so it’s important to assess how they can best support the acquisition and maintenance of equipment needed for successful project execution.

– Advantages and disadvantages of different loan types

When considering financing strategies for construction projects, understanding the advantages and disadvantages of various loan types is crucial for effective project management. Traditional bank loans offer long-term repayment options, providing stability but may involve stringent requirements and a more complex application process. On the other hand, equipment leasing can be advantageous for businesses seeking flexibility, as it allows for regular upgrades and potential tax benefits.

A lender evaluation becomes essential when exploring these options. Each financing approach has its own set of pros and cons. For instance, equipment leasing might limit ownership but can offer cost savings and reduced financial risk. In contrast, a loan application process with a non-traditional lender could be faster, but it may lack the stability and predictability of a bank loan. Balancing these factors is key to selecting the optimal financing strategy that aligns with project goals and overall business objectives.

Lender Evaluation and Selection

When seeking construction equipment loans, one of the critical steps in the process is choosing the right lender. Lender evaluation involves a meticulous process where borrowers must assess various factors to ensure they find a financial institution that aligns with their financing strategies. Start by examining the lender’s expertise in equipment leasing for the construction sector. This knowledge can significantly impact project management, as specialized lenders often offer tailored solutions and a deeper understanding of the industry.

Additionally, consider the lender’s reputation, their terms and conditions, interest rate structures, and any potential tax benefits associated with their loans. A thorough review of the loan application process and terms will help you make an informed decision, ensuring that your project has a solid financial foundation from the outset.